How To Calculate Annual Net Income With Accounts Receivable

Definition and How to Calculate 9 octubre 2019 By. Investors what to know that their investment will continue to appreciate and that the company will have enough cash to pay.

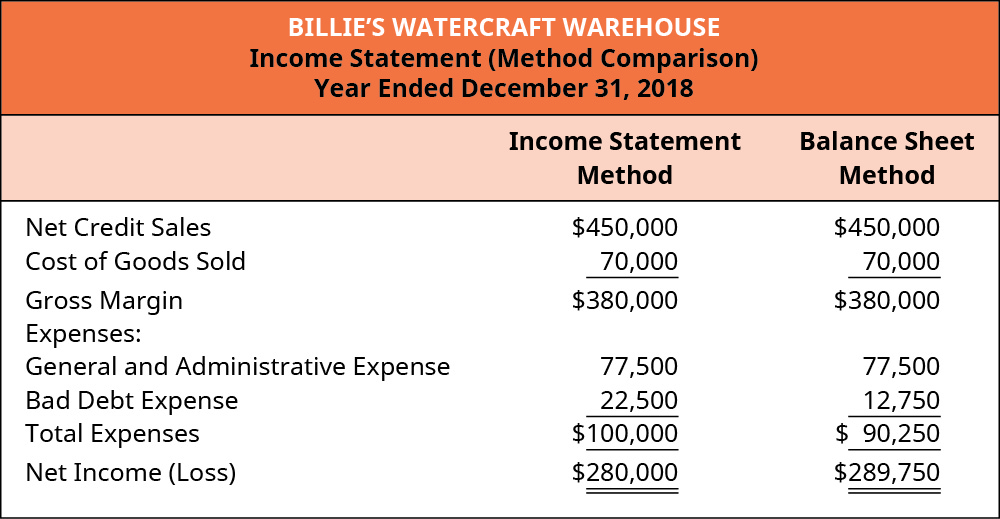

Discuss The Role Of Accounting For Receivables In Earnings Management Principles Of Accounting Volume 1 Financial Accounting

First use a companys balance sheet to calculate average receivables during the period.

How to calculate annual net income with accounts receivable. 1000000 Gross trade receivables - 30000 Allowance 970000 Net receivables. Its net receivables figure and percentage are calculated as follows. 60000 2000 30 This means XYZ Inc.

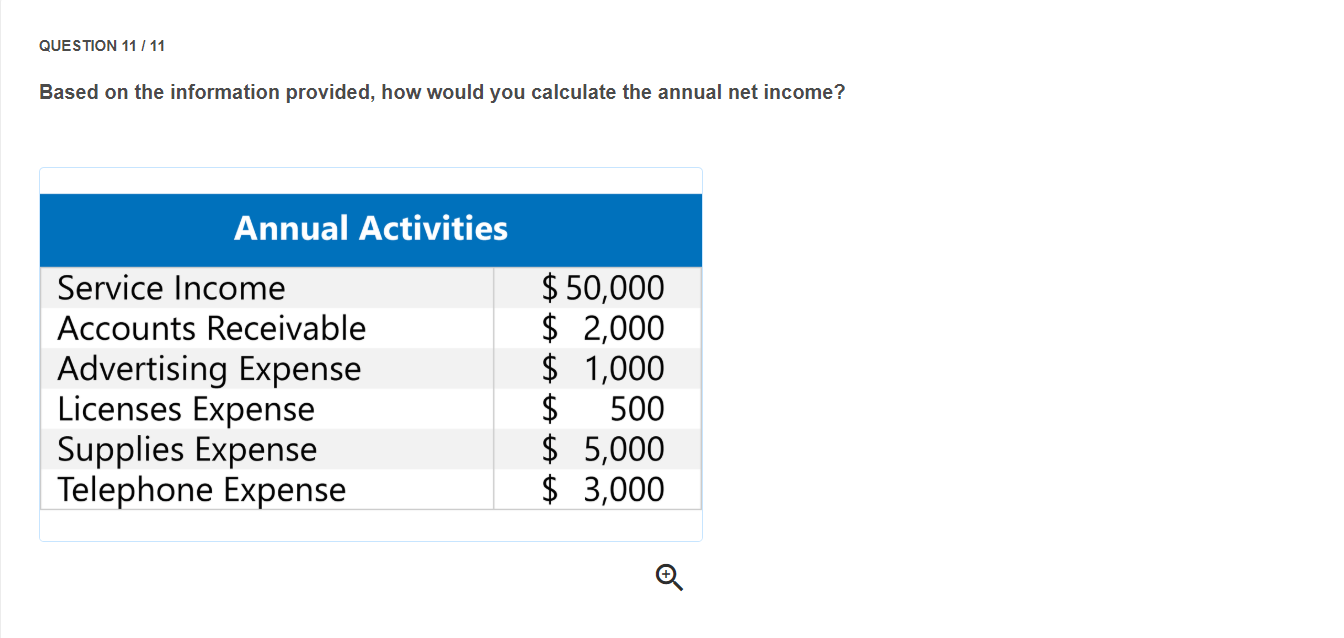

This means that on average customers get 661 worth of credit from Richeys Sports Center that they must pay back. To analyze your annual net income you must ensure deducting specific costs from your overall gross income. Question Based on the info provided how would you calculate the annual net income.

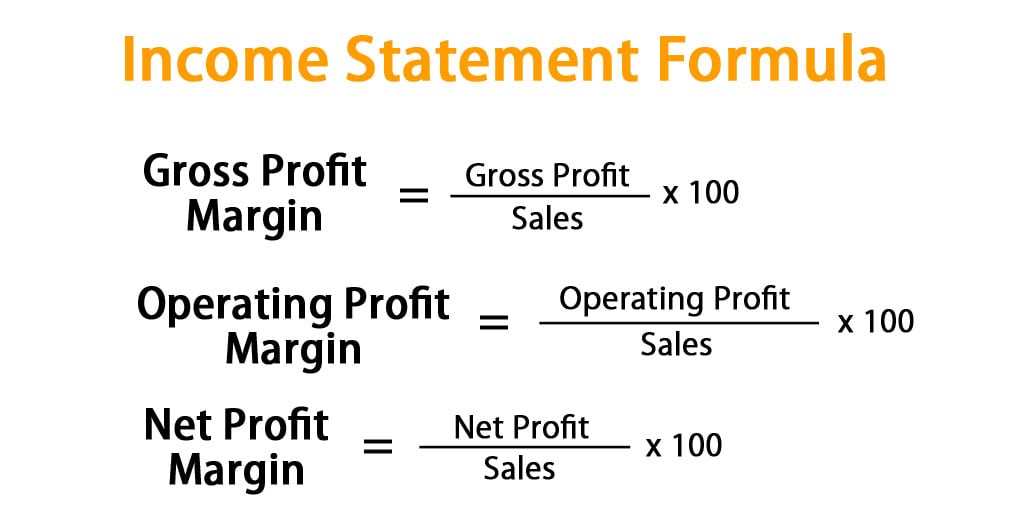

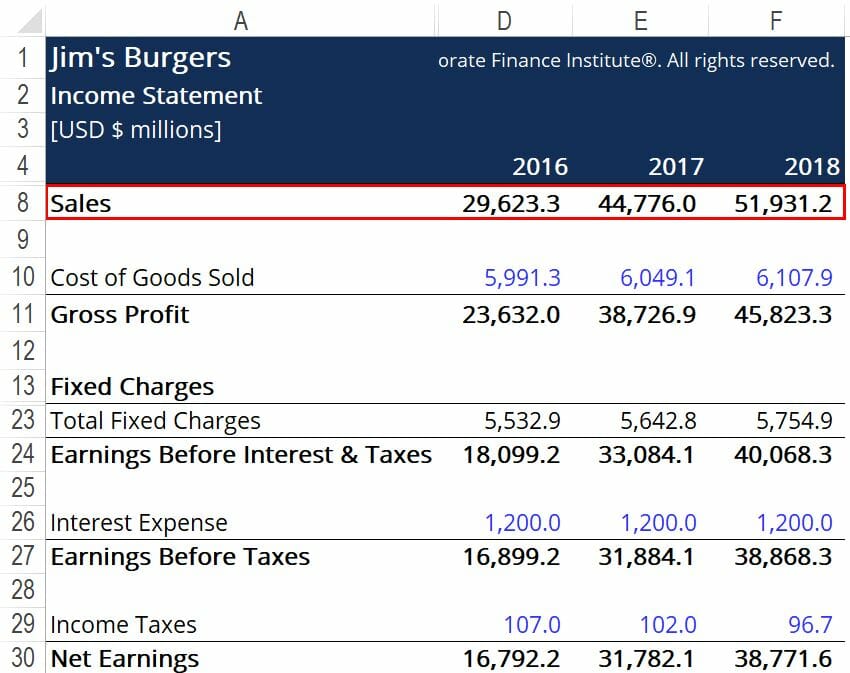

This calculation tells how many times a companys accounts receivable turns over. How to calculate accounts receivable turnover The AR turnover ratio is calculated using data found on a companys income statement and balance sheet. Net credit sales Credit Sales Credit sales refer to a sale in which the amount owed will be paid at a later date.

For example suppose a company has 730000 in net credit sales and an average balance in accounts receivable of 70000. This is a companys annual net credit sales divided by its average balance in accounts receivable for the same time period. Looking at revenue alone - such as ticket sales in a.

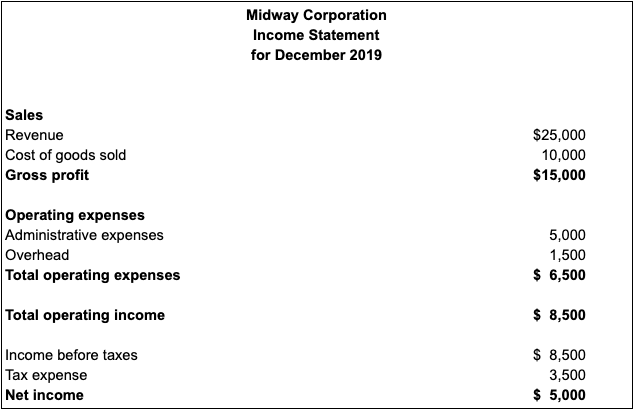

Annual net income is the total money earned in a span of 12 months after specific subtractions are done from your gross income. Has an accounts receivable turnover ratio of 30. Sales revenue is a P and L component and constitutes the linkup between accounts receivable and an income statement.

Accounts Receivable Turnover Ratio Net Credit Sales Average Accounts Receivable. To calculate the accounts receivable turnover ratio we then divide net sales 60000 by average accounts receivable 2000. When an organization sells goods or provides services on credit a bookkeeper debits the customer receivables account and credits the sales revenue account.

Imagine a net trawling a bank account and all the money for costs such as rent electricity wages insurance marketing etc slipping through the holes. Whats left in the net afterwards is the net income or net profit. Net income is an important figure when valuing a business or assessing the cost-effectiveness of an organisation.

The formula to calculate Accounts Receivable Turnover is to add the beginning and ending accounts receivable to get the average accounts receivable for the period and then divide it into the net credit sales for the year. With a little extra information calculating net income from the balance sheet using only assets liabilities and equity should be simple enough. Heres how to calculate net income with three.

For example an organization has 1000000 of gross receivables outstanding and an allowance for doubtful accounts of 30000. The accounts receivable turnover ratio formula is as follows. Using this same business you can also calculate the turnover ratio.

Service Income 50000 Accounts Receivable 2000. Investors creditors and company management tend to focus on the net income calculation because it is a good indicator of the companys financial position and ability to manage assets efficiently. Your paycheck will also consist of your annual net income listed below.

Average accounts receivable 30 800 200 400 500 2000 700 4630 7 661. Generally speaking net income is revenues minus expenses Under the accrual basis of accounting revenues and accounts receivable are recorded when a company sells products or earns fees by providing services on credit. This makes sense because cash transactions dont give rise to receivable amounts.

Average Accounts Receivable Formula beginning AR ending AR 2. The higher this ratio is the faster your customers are paying you. Net Annual Credit Sales Beginning Accounts Receivable Ending Accounts Receivable 2.

Use the equation 730000 80000 9125 This means that the companys accounts receivable.

A Service Income Accounts Receivable B Service Chegg Com

Income Statements Explained Accountingcoach

How To Calculate Net Income 12 Steps With Pictures Wikihow

Accounts Receivable Turnover Ratio Tools Examples The Blueprint

Income Statement Formula Calculate Income Statement Excel Template

Cash Flow Statement January February Transactions Accountingcoach

How To Determine Net Income In Accounting 11 Steps

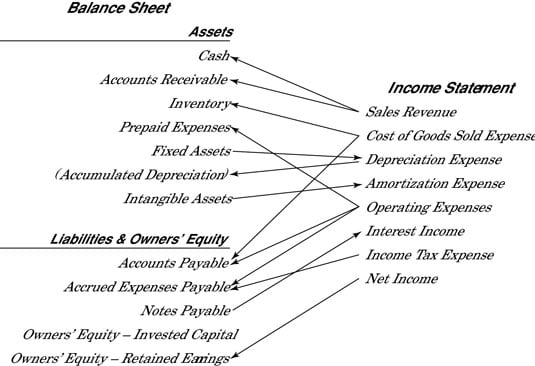

Connecting The Income Statement And Balance Sheet Dummies

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Calculate Net Income 12 Steps With Pictures Wikihow

Taxable Income Formula Calculator Examples With Excel Template

Bookkeeping Balance Sheet And Income Statement Are Linked Accountingcoach

Accounts Receivable To Sales Ratio How To Calculate The Ratio

How To Calculate Net Income 12 Steps With Pictures Wikihow

How Do The Income Statement And Balance Sheet Differ

How To Find Net Income Calculations For Business

Accounting Relationship Linking The Income Statement And Balance Sheet Money Instructor

Post a Comment for "How To Calculate Annual Net Income With Accounts Receivable"