How Much Should Rent Be If Your Yearly Income Is 35000

You have monthly payments on your auto loan 200 student loan 250 and mortgage 800 for a total of 1250. Use this calculator to calculate how expensive of a home you can afford if you have 35k in annual income.

50 30 20 Rule The Realistic Budget That Actually Works N26

Letting agents and landlords need to know that you can afford your rent.

How much should rent be if your yearly income is 35000. For example if the rent is 500month and the renter earns 2000month their rent to income ratio would be 25. To calculate how much you should spend on rent youd simply multiply your gross income by 30. So to help you budget effectively we created this handy rent calculator.

Monthly rent PCM If you were renting a property with a monthly rent of 0 then your total income will need to be. Rent to Income Ratio The rent-to-income ratio is a formula used to measure a renters ability to pay rent and is calculated by dividing rent by the renters income stated as a percentage. Using this rule you can quickly calculate how much you can afford in rent per month.

For example suppose an applicant earns 150000 per year. You can use the slider to change the percentage of your income you want spend on housing. Say you earn 36000 per year or 3000 per month.

Enter in your total Gross annual income below and click Calc Rent and we will tell you how much rent you can afford. Gross earnings per year 12 X 03 Maximum monthly rental income. To calculate how much rent you can afford we multiply your gross monthly income by 20 30 or 40 based on how much you want to spend.

Savings debt and other. If you use the additional options we deduct the rent from your income and subtract your debt expenses and savings from the remaining money depending on. Make sure to consider property taxes home insurance and your other debt payments.

How much home can I afford if I make 35000. As a general rule its a good idea to keep housing costs to 30 of your income or less. When you divide your monthly debt 1250 by your monthly income 3000 you get a DTI of about 42.

With 5000 at your disposal every month we recommend that you spend approximately 1500 on rent which is about 26 of your monthly net income. This calculator shows rentals that fit your budget. The general rule is that your monthly apartment rent excluding utilities should not exceed 30 of your gross monthly income.

In simple terms the 30 rule recommends that your monthly rent payment not be more than 30 of your gross monthly income. This is useful if you want to know 35k a years is how much an hour Answer is 1807 assuming you work roughly 40 hours per week or you may want to know how much 35k a year is per month after taxes Answer is 236406 in this example remember you can edit these figures to produce your own detailed tax calculation. Input your net after tax income and the calculator will display rentals up to 40 of your estimated gross income.

As a general rule you should spend no more than 30 of your monthly income on rent. In other words no more than 30 of your annual income should go toward housing costs. What is the monthly payment of the mortgage loan.

Use the formulas in this rent calculator to come up with an effective plan to see how much to spend on rent for your next apartment. 15000012 X 03 3750. The income to rent ratio will be.

Expenses could impact the amount you want to spend on rent each month. This may be higher or lower depending on the other expenses you have such as any debt payments you need to make. If a guarantor is required then they will also need to have a total income of.

For example if you make 50000 per year you can spend 15000 annually on rent. Youll be left with 3500. The 30 percent rule states you shouldnt spend more than 30 percent of your income on rent.

For example if your gross monthly income is 5000 the maximum you should be paying for rent is 1500 30 of 5000 is 1500. So if you have a 35000-a-year job the maximum rent you can afford is 875 per month. Property managers typically use gross income to qualify applicants so the tool assumes your net income is taxed at 25.

Here are four tactics to consider that will help you calculate how much to budget for rent and stay within your financial means. Others look for 30 of your monthly income but in reality these two methods are just two different mathematical ways to get to the same place. Use whichever calculation is easier for you to figure out.

But in a city. Its mathematical representation looks like this. Use this slider to see how spending more or less on rent affects your budget.

Now if the rental site asks for 4000 per month the applicant. That way youll have enough money to cover your remaining expenses without risking debt.

Corporate Tax Rates In France A Guide For Entrepreneurs Expatica

What Is My Net Salary On A Gross Salary Of 3 000 Eur In Holland Can I Live On That In Amsterdam Expatriates Stack Exchange

How Much Should You Be Spending On Rent Turn2us

Ask Emily My Partner Makes Twice As Much Money As I Do What S The Best Way To Split The Rent Quartz

How To Calculate Monthly Rent Propertyme

Wdp Annual Report 2020 By Wdp Warehouses With Brains Issuu

Hotel Revenue Management Formulas Kpis Calculations Use Cases Upstay

How Much Rent Can I Afford Rent Calculator

50 30 20 Rule The Realistic Budget That Actually Works N26

How Much To Spend On Rent In Australia Savings Com Au

How Much Rent Can I Afford Ubank

50 30 20 Rule The Realistic Budget That Actually Works N26

Complete Guide To Taxes Freelancers And The Self Employed Employee Tax Forms Addition Words Quarterly Taxes

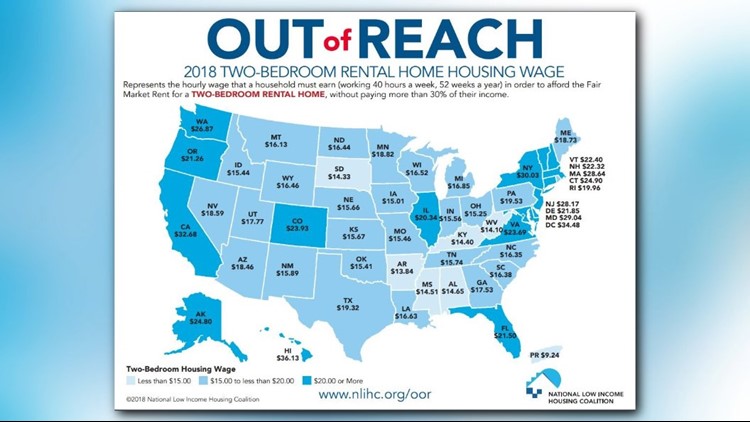

This Is How Much You Need To Earn For Rent In Washington King5 Com

Post a Comment for "How Much Should Rent Be If Your Yearly Income Is 35000"