How Do I Calculate My Biweekly Salary

How do you calculate hourly rate from annual salary. If you have 2 unpaid weeks off you would take off 1 biweekly pay period.

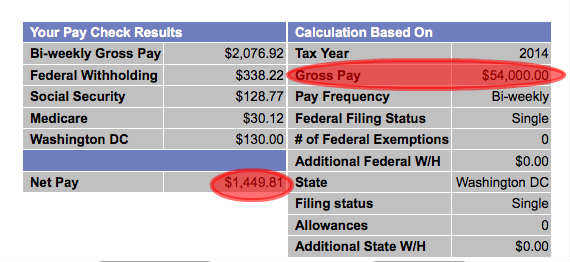

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Because the annual calendar creates an.

How do i calculate my biweekly salary. Gross and Net Pay. Based on the number of withholding allowances claimed on your W-4 Form and the amount of wages calculate the amount of taxes to withhold. How to Calculate Your Monthly Salary if You Are Paid Bi-Weekly Biweekly Salary Basics.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Salary Before Tax your total earnings before any taxes have been deducted. Convert Biweekly Salary to Monthly.

How Your Paycheck Works. There are four main schedules. Hourly Wage 28000 yearly is 1455 hourly.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. 28000 yearly is 538 weekly. What is the hourly rate for 28000 pounds a year.

Federal Income Tax Calculation - Biweekly Payroll Period. While there are 52 weeks in a year many employers give employees around 2 weeks. February 18 30 year fixed Loan interest rates Composite home price nsa Once you have the relevant tax and legal information to set up payroll you can choose a schedule that works best for your business.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. This calculator will help you to quickly convert your annual salary into the equivalent hourly income. The adjusted annual salary can be calculated as.

How do i calculate my biweekly salary. Its more complex than you may think. Since you receive two extra paychecks per year on a biweekly cycle there are two months when you need to perform some extra calculations to find your take-home pay.

Simply enter your annual income along with your hours per day days per week work weeks per year to calculate your equivalent income. Your average tax rate is 221 and your marginal tax rate is 349. Can be used by salary earners self-employed or independent contractors.

Thats because your employer withholds taxes from each paycheck. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Many jobs with steady hours especially professional office jobs quote salary in terms.

Most employers that use biweekly payroll calculate your payment by dividing your annual salary. If you make 55000 a year living in the region of Texas USA you will be taxed 9295. 30 8 260 - 25 56400.

A small disadvantage to biweekly pay is the ability to accurately calculate your take-home pay. Also known as Gross Income. That means that your net pay will be 45705 per year or 3809 per month.

To calculate hourly rate. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Youll then get a breakdown of your total tax liability and take-home pay. To determine the amount of wages subject to federal tax you must first add any taxable fringe benefits and taxable employer-paid deductions to your gross pay amount. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

That means that your net pay will be 40512 per year or 3376 per month. Contents Calculate bi-weekly net Salary. If you work 50 weeks a year are paid ever other week then multiply those biweekly pay periods by 25 to calculate the associated.

Review your pay stub. Continue reading How Do I Calculate My Biweekly. When you get paid semimonthly your paycheck is evenly divided twice making it easier to factor in deductions like taxes and benefits.

To calculate your federal withholding tax find your tax status on your W-4 Form. Your pay before withholdings for taxes and other costs are removed is known as your. Enter the dollar amount of the wage you wish to convert.

If all time off is paid you would multiply your biweekly pay by 26 to convert it to the equivalent annual salary. All bi-weekly semi-monthly monthly and quarterly figures are derived from these annual calculations. 28000 yearly is 1077 biweekly.

Monthly semi-monthly biweekly and. If you participate in tax deferred retirement pre-tax benefits. Daily Wage 28000 yearly is 108 daily.

Your average tax rate is 169 and your marginal tax rate is 297. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. Calculating the monthly income when you are paid biweekly is as easy as multiplying your paycheck amount by 26 and then dividing that number by 12.

You can then subtract 15190 from the total biweekly taxable gross pay for each withholding. How to Calculate Your Biweekly Salary Annual Salary and Biweekly Pay. This number is the gross pay per pay period.

Simply enter a wage select its periodic term from the pull-down menu enter the number of hours per week the wage is based on and click on the Convert Wage button. There are 52 weeks per year. Divide weeks by 2 in order to covert them into biweekly pay periods.

Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. 28000 pounds per year is about 15 pounds an hour. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Calculating Your Federal Withholding Tax.

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Apps Games

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

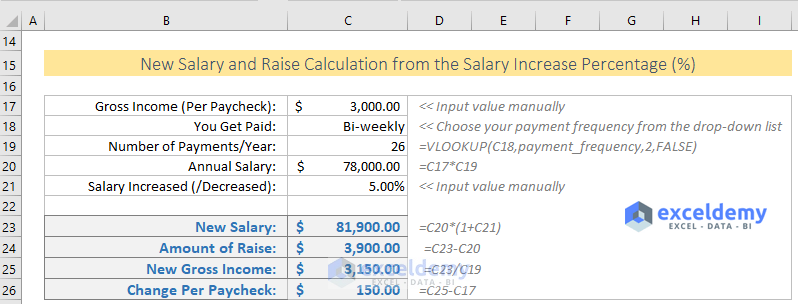

How To Calculate Salary Increase Percentage In Excel Free Template

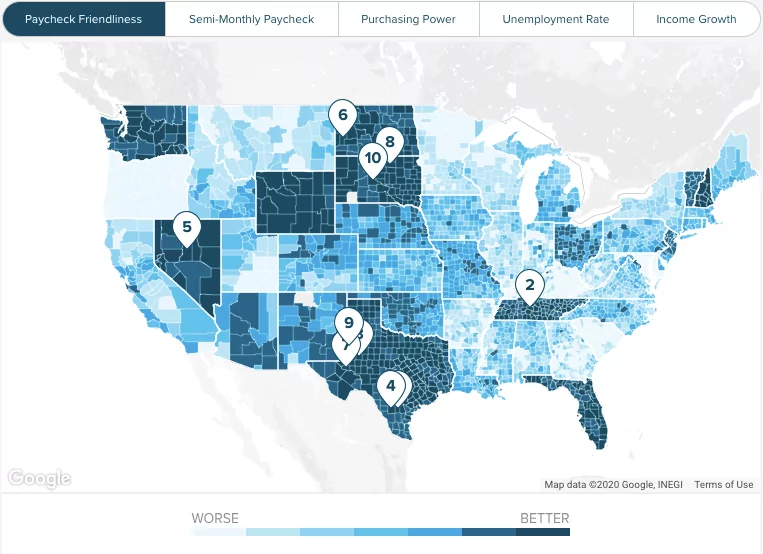

Free Online Paycheck Calculator Calculate Take Home Pay 2021

How To Calculate Monthly Income From Biweekly Paycheck Hassle Free Savings

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Monthly Income From Biweekly Paycheck Hassle Free Savings

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

3 Ways To Calculate Your Hourly Rate Wikihow

New Tax Law Take Home Pay Calculator For 75 000 Salary

How Much Is 15 Dollars An Hour Biweekly After Taxes Tax Walls

How To Calculate A Paycheck For Your Employees Youtube

4 Ways To Calculate Annual Salary Wikihow

Pennsylvania Paycheck Calculator Smartasset

Gross Pay And Net Pay What S The Difference Paycheckcity

How To Understand Your Paycheck And Meet Your Tax Goals

Post a Comment for "How Do I Calculate My Biweekly Salary"