Calculate My Annual Income After Taxes

For this example the employee would pay 5000 USD in federal taxes and 3000 USD in state taxes. Use our interactive calculator to help you estimate your tax position for the year ahead.

What You Need To Know About Income Tax Calculation In Malaysia

This includes the extension of the Low and Middle Income Tax Offset LMITO for the 2021-22 tax year.

Calculate my annual income after taxes. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Annual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. Your Total Income After Tax Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income.

Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more. Your average tax rate is 222 and your marginal tax rate is 361. Please note the results are approximate.

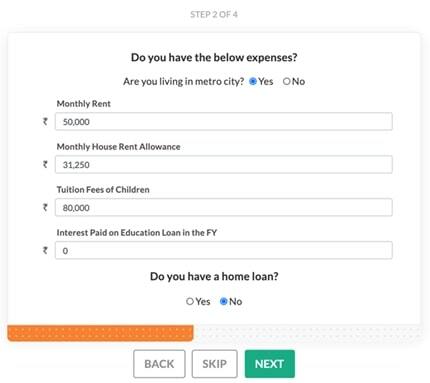

Gross annual income refers to all earnings Earnings Before Tax EBT Earnings before tax or pre-tax income is the last subtotal found in the income statement before the net income. We have updated our income tax calculator according to the latest income tax rates rules so you may calculate your tax with accuracy and without worry. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income.

Income Tax Calculator Switzerland Find out how much your salary is after tax. Use this calculator to quickly estimate how much tax you will need to pay on your income. Social Security and Medicare.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Salary Before Tax your total earnings before any taxes have been deducted. For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387.

Budget 2021-22 update This calculator has been updated with tax changes set out in the 2021-22 Budget. Total Taxes 1413 543 865 2821 75000 x 02821 2115750 Therefore the individuals total annual taxes are 2115750. Cantonal tax - CHF 1490.

That you are an individual paying tax and PRSI under the PAYE system. Find out your take-home pay - MSE. Next from AGI we subtract exemptions and deductions either itemized or.

Youll then get a breakdown of your total tax liability and take-home pay. An income tax calculator is a simple online tool which can help you calculate taxes payable on your income. Scroll down to see more details about your.

To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator. Personal Tax - CHF 24. How Income Taxes Are Calculated.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Terms conditions and assumptions. The Tax Caculator Philipines 2021 is using the latest BIR Income Tax Table as well as SSS PhilHealth and Pag-IBIG Monthy Contribution Tables for the computation.

To calculate the individuals after-tax income we must first calculate their total taxes by summing up their tax rates. Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April. The result in the fourth field will be your gross annual income.

Can be used by salary earners self-employed or independent contractors. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Due to the complexity of the tax and PRSI rules results are based on a number of tax assumptions as follows.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. If your salary is 40000 then after tax and national insurance you will be left with 30840. Enter your gross income.

The gross total income is the sum of income under the six income heads. Youll then get a breakdown of your total tax liability and take-home pay. The tax is payable at the applicable tax rate or tax slab on the net income.

If youre wondering how to calculate gross annual income by yourself - use the formula mentioned earlier. To compute the salary after tax one would simply multiply the gross income 100000 by each of the tax rates. Tax Calculator Philippines 2021.

Income tax is payable on the total income and not the gross total income as calculated in accordance with the income tax act. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k. If you wish to know more about FY 20-21 income tax slabs click now.

Where do you work. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. Just remember to use your gross hourly wage.

The deductions available to the taxpayer is deducted from gross total income this is the net total income. Direct Federal Tax - CHF 234. This means that after tax you will take home 2570 every month or 593 per week 11860 per day and your hourly rate will be 1923 if youre working 40 hoursweek.

Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. Communal tax - CHF 1773. Church tax - CHF 209.

Also known as Gross Income.

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

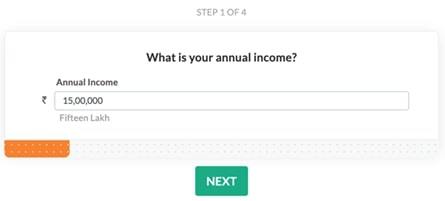

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

21 000 After Tax 2021 Income Tax Uk

How To Calculate Income Tax In Excel

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Calculate Income Tax In Excel

Net Income After Tax Niat Overview How To Calculate Analysis

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Calculate My Annual Income After Taxes"