Calculate Gross Annual Taxable Income

PS Personal Allowances. To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator.

Taxable Income Formula Calculator Examples With Excel Template

It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC.

Calculate gross annual taxable income. The bonus received during the financial year must be added for the income that is being calculated. To calculate taxable income subtract all deductions and allowance for exemptions from the adjusted gross income. Also calculated is your net income the amount you have left over.

The first step is to add up all of your income youve earned for the past tax year to get a gross income total. Just remember to use your gross hourly wage. Summary report for total hours and total pay.

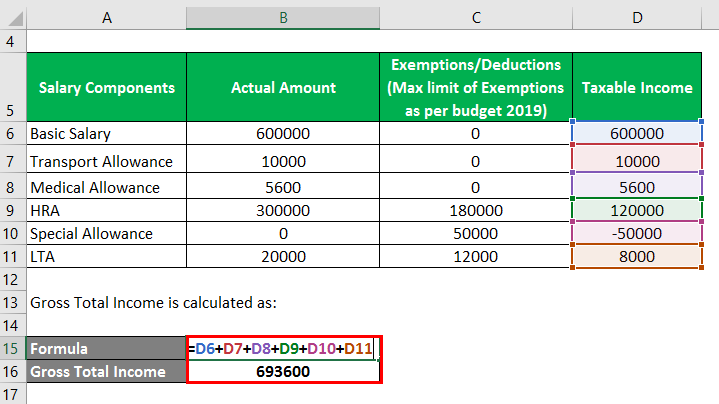

Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. Total Taxable Income is calculated using the formula given below Total Taxable Income Gross Total Income Deductions Exemptions allowed from Income Total Taxable Income 693600 40000 15000 14000 6500 Total Taxable Income 733600 35500. Following is the procedure for the calculation of taxable income on salary.

Base on our sample computation if you are earning 25000month your taxable income would be 23400. Does not include self-employment tax for the self-employed. An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimes.

If youre wondering how to calculate gross annual income by yourself - use the formula mentioned earlier. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. NI National Insurance Contributions.

The IRS requires you to report all income you earn. Estimate your US federal income tax for 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. The calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax liability of an individual.

Gather your salary slips along with Form 16 for the current fiscal year and add every emolument such as basic salary. GI Gross Income. Firstly gross sales have to be confirmed by the sales department.

Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400. It also will not include any tax youve already paid through your salary or. Next take out the exemptions provided on the salary components.

This link opens in a new window. Gross income includes all income you receive that isnt explicitly exempt from taxation under the Internal Revenue Code IRC. This will include all the components of your salary including House Rent Allowance HRA Leave Travel Allowance LTA and special allowances like food coupons and mobile reimbursements etc.

Calculate your gross income First write down your annual gross salary you get. In 2009 the standard deduction is. The taxable income formula for an organization can be derived by using the following five steps.

Next the operating expense is also. Taxable income is the portion of your gross income thats actually. Look into the income tax table and determine your salary column.

TI Taxable Income. To calculate taxable income you begin by making certain adjustments from gross income to arrive at adjusted gross income AGI. This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly.

Next the cost of goods sold is determined by the accounts department. 32000 21000 53000 Total gross annual income If Sarah is eligible for deductions of 5000 for education andor childcare expenses she may be able to lower her taxable income in some jurisdictions. If this is the case her net taxable income would be as follows.

Once you have calculated adjusted gross income you can subtract any deductions for which you qualify either itemized or standard to arrive at taxable income. TE Tax Exempt Expenses. 53000 5000 48000 Net taxable income.

To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. IT Income Tax Free Schemes. Does not include income credits or additional taxes.

Taxable income adjusted income deductions allowance for exemptions With deductions you can itemize deductions or use the standard deduction. The calculator will calculate tax on your taxable income only. Do I need to Know my Taxable Income.

Calculate the gross amount of pay based on hours worked and rate of pay including overtime. How to calculate taxable income. The result in the fourth field will be your gross annual income.

It will take between 2 and 10 minutes to use this calculator. Subtract your total deductions to your monthly salary the result will be your taxable income.

Income Tax Formula Excel University

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Income Tax Calculator For Fy 2021 22 Calculate Income Tax Online For Old Tax Regime

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

Income Tax Calculator For Fy 2021 22 Calculate Income Tax Online For Old Tax Regime

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Net Income 12 Steps With Pictures Wikihow

Excel Formula Income Tax Bracket Calculation Exceljet

Income From House Property How To Calculate Income From House Property Tax2win

Taxable Income Formula Calculator Examples With Excel Template

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

How To Compute Quarterly Income Tax Return Philippines 1701q Business Tips Philippines

Post a Comment for "Calculate Gross Annual Taxable Income"