Work Out Annual Income Before Tax

For the current tax year the below figures apply. This calculator has been updated with 2021-22 income tax and National Insurance rates and thresholds as set out in the Budget.

Pin On Product Brochure Template

Under your earnings or wages your current pay before taxes should be shown.

Work out annual income before tax. After-Tax Income Gross Income Taxes. Now we can calculate their after-tax income. Total Taxes 1413 543 865 2821.

If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. If your pay stub says your earnings before deductions for that two-week period are 2500 you can multiply that by 26 to get 65000. The result is your annual salary before taxes.

To calculate the individuals after-tax income we must first calculate their total taxes by summing up their tax rates. Multiply your monthly salary by how many hours you work in a year. On earnings of 12571 and up to 50270 you pay tax at a rate of 20.

To calculate your annual income before taxes obtain a copy of your most recent paycheck. The agi calculation is on page one of. It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC.

It also will not include any tax youve already paid through your salary or wages or any ACC earners levy you may need to pay. June 17 2021 June 17 2021 Leave a Comment. To see how much you owe for the previous year use the drop-down to select the 2020-212019-20 or 2018-19 tax year.

All Income tax dates Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. You then make income reconciliation adjustments or expense reconciliation adjustments to reconcile your business operating profit or loss with your business taxable income. Monthly taxes 25.

Multiply your monthly salary figure by 12. Alternatively you can use our calculator to work out your total tax bill - simply enter your salary below. If you are carrying on a business to work out your taxable income use your business operating profit or loss as a starting point.

Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. Adjusted gross income AGI is an individuals taxable income after accounting for deductions and adjustments. Set the net hourly rate in the net salary section.

Is annual income before or after taxes. To better compare withholding across counties we assumed a 50000 annual income. On the other hand net annual income is the amount of money an individual actually receives after taxes and other deductions are taken off.

You start paying tax on anything you earn over your personal allowance. The formula to work out your taxable income is. Net income is the money after taxation.

Viele bersetzte Beispielstze mit annual income before tax Deutsch-Englisch Wrterbuch und Suchmaschine fr Millionen von Deutsch-bersetzungen. You can take that amount and multiply it by the number of pay periods in a year and then divide by 12. Or other earnings tips interest dividends distributions gainslosses etc type income rental incomeexpenses retirement plans pensions or a.

There are two ways to determine your yearly net income. Annual net income calculator. So if you get paid every two weeks you have 26 pay periods in one year meaning youll get 26 paychecks.

Taxable income equals assessable income minus deductions. This means that after tax you will take home 2570 every month or 593 per week 11860 per day and your hourly rate will be 1923 if youre working 40 hoursweek. Therefore the individuals total annual taxes are 2115750.

While there are 52 weeks in a year many employers give employees around 2 weeks paid vacation between the year end holidays and other regularly scheduled. Heres how you work out your agi. 40000 After Tax If your salary is 40000 then after tax and national insurance you will be left with 30840.

If you work 2000 hours a year and make 25 per hour then you would add 4 zeros from the annual salary multiply the result by 2 to get 50000 per year. If you get Medicare and your income is low your state may pay your Medicare premiums and in some cases your deductibles and. Some money from your salary goes to a pension savings account insurance and other taxes.

75000 x 02821 2115750.

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Income Tax Return

The Salary Calculator Irish Take Home Tax Calculator Salary Calculator Weekly Pay Salary

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Tax Calculator Calculator Design Calculator App Financial Calculator

How To Declare Your Income And Expenses As A Blogger Canada Save Spend Splurge Tax Forms Income Tax Income

Excel Formula Income Tax Bracket Calculation Exceljet

Sujit Talukder On Twitter Budgeting Income Tax Tax

Income Tax Calculator Income Tax Life Insurance Companies Income Tax Return

Massachusetts Income Tax Calculator Smartasset Com Income Tax Income Tax

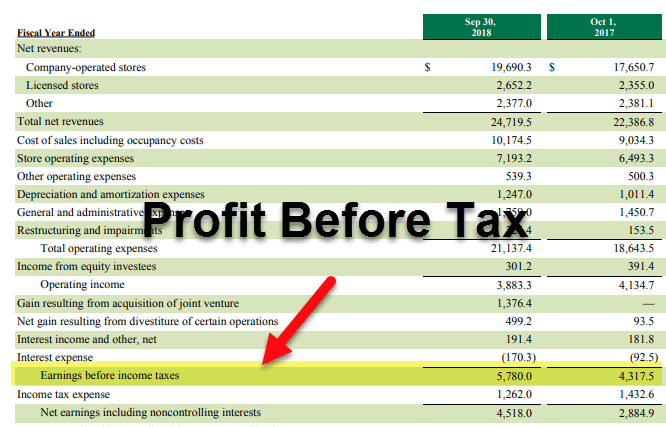

Profit Before Tax Formula Examples How To Calculate Pbt

How To Fill Form W2 Tax Forms Accounting Services W2 Forms

Here S A Nice Long Read On How To Figure Out The Irs 1040 Form To Fill Out Your Taxes For Your Salon Note That This Is 10x Tax Forms Irs

How To Calculate Net Income 12 Steps With Pictures Annual Income Net Income Income Calculator

Ird Number Applications Find Out About Tax Deductions Tax Refund Small Business Management

Florida Income Tax Calculator Smartasset Com Property Tax Income Tax Tax

Post a Comment for "Work Out Annual Income Before Tax"