How To Work Out Annual Salary From Hourly Rate Nz

Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage. This shows that Dan is paid more than.

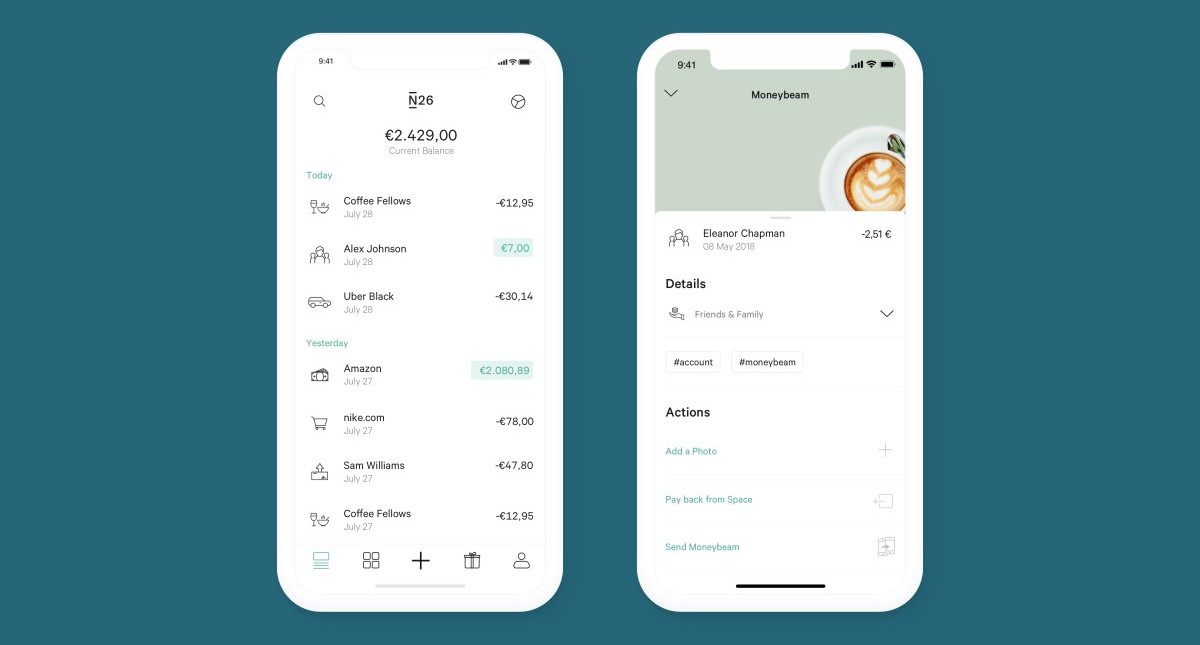

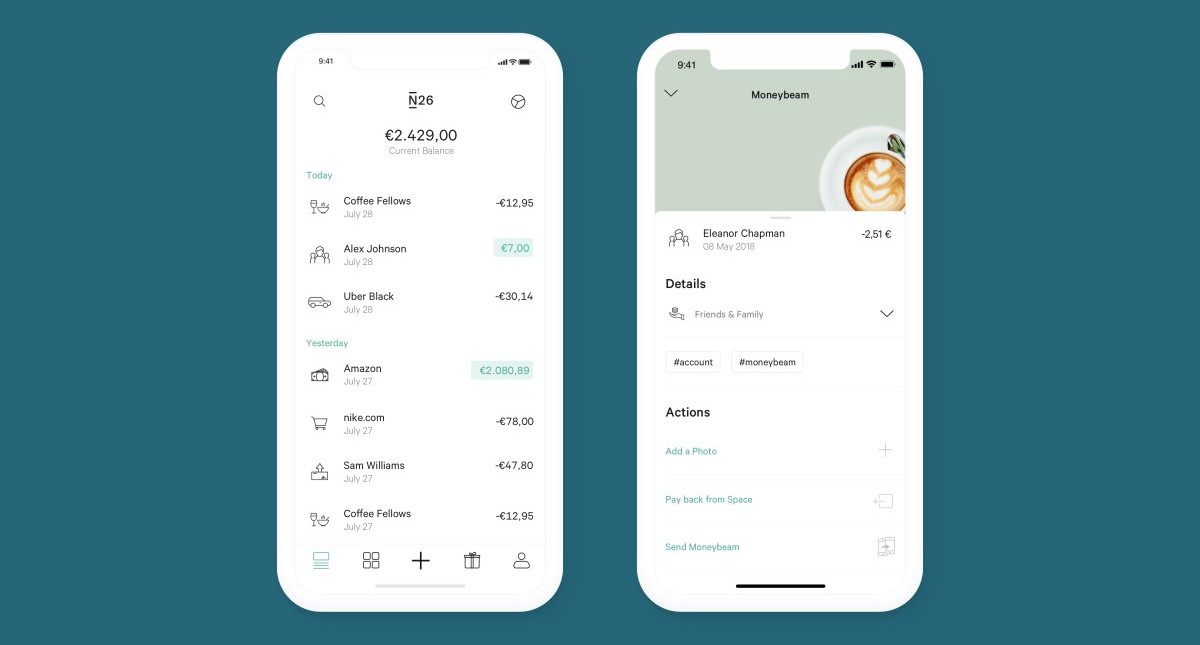

Base Salary Explained A Guide To Understand Your Pay Packet N26

If you are paid a salary for a range of hours each week we divide your salary by the maximum number of hours you could work to calculate your level.

How to work out annual salary from hourly rate nz. For example for 5 hours a month at time and a half enter 5 15. For helpful advice regarding switching to a contract rate or employing people please contact us. His employer uses a calculation known as the standard 2080 method.

To keep the calculations simple overtime rates are based on a normal week of 375 hours. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in New Zealand affect your income. To find the ACC levy rate for your industry go to accgovtnz.

22 lignes To determine your annual salary take your hourly wage and multiply it by the number of. There are two options in case you have two different overtime rates. Calculator 2 can be used if you already have an idea of the annual salary youd like to pay the employee.

We begin by dividing the annual salary by the number of weeks in an year 52 weeks. As a general guide we use the formula of calculating your base salary 30 of your base salary divided by 2000 hours to arrive at an hourly rate. Calculate your take home pay from hourly wage or salary.

How to use the New Zealand Income Tax Calculator Just enter your gross annual salary into the box and click Calculate - then well show you a breakdown of how much PAYE tax youll pay and what your kiwisaver and student loan contributions will be. This tells you your weekly salary. Salary to Hourly - Omni Calculator.

50000 per year 52 weeks 40 hours per week 2404 per hour. Heres how it looks once we put these numbers into the equation. Formula to calculate hourly rate.

Using this method Dons hourly rate is 46163 2080 2219 per hour. 50000 divided by your 1350 hours means you need to add another 3700 to your income charge - bringing your new hourly rate up to 9800 per hour. The annual salary in our case is 50000 and we work 40 hours per week.

KiwiSaver Employer Contribution Year. New Zealands Best PAYE Calculator. Jun 12 2020 For this purpose lets assume some numbers.

Also known as Gross Income. Monthly wage to hourly wage. Please note this calculator does not factor in ACC levies which are hugely variable.

Calculator 2 will work out the overall annual cost as well as the hourly rate. Youll then get a breakdown of your total tax liability and take-home pay. Then divide the result by the number of hours worked.

No paid sick leave. This method divides the annual salary by 2080 4052 to get an hourly rate. For example if you are paid NZD 55000 an year for 40 to 45 hours of work a week the calculation is.

Of hours worked in a week Daily basic rate of pay 12 x Monthly basic rate of pay ----- 52 x Number of days a part-time employee is required to work in a week. Hourly basic rate of pay 12 x Monthly basic rate of pay ----- 52 x No. Enter the number of hours and the rate at which you will get paid.

Take your hourly salary and multiply it by the number of hours you work each week. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. Salary Before Tax your total earnings before any taxes have been deducted.

No paid annual leave. If you know how much you intend paying on an hourly basis then use calculator 1 to work out the annual cost for your business. Don works 40 hours a week and is paid a salary of 46163.

Number of hours per week x hourly rate x number of weeks in a year annual salary Again there are 52 weeks in each year and for this example lets say you work 35 hours per week and earn 1099 per hour. The 30 is to account for. To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week.

5000 per month 12 52 weeks 40 hours per week 2885. Multiply this by the number of weeks in a year 52 to get your yearly salary. If you work 40 hours per week and you earn 20 per hour calculate your weekly salary.

In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work. Please check ACCs website. Annual salary to hourly wage.

Simply dividing your salary by the number of hours you work each year will result in you under paying yourself. 35 hours x 1099 x 52 weeks annual salary. Salary After Tax the money you take home after all taxes and contributions have been.

Some employers use alternative methods such as the Standard 2080 method. You can vary the kiwisaver contribution rate to see the effect on your net pay.

Changing An Employee S Salary Or Hourly Rate Myob Accountright Myob Help Centre

If You Are Wondering How Much Web Development Costs Here Are Some Figures From Around The World Web Development Development Infographic

Salary Vs Hourly Pay What Are The Differences Indeed Com

Pin On Posts From Passiveincomenz Com

Pay Gap Between Ceos And Workers By Country 2018 Statista

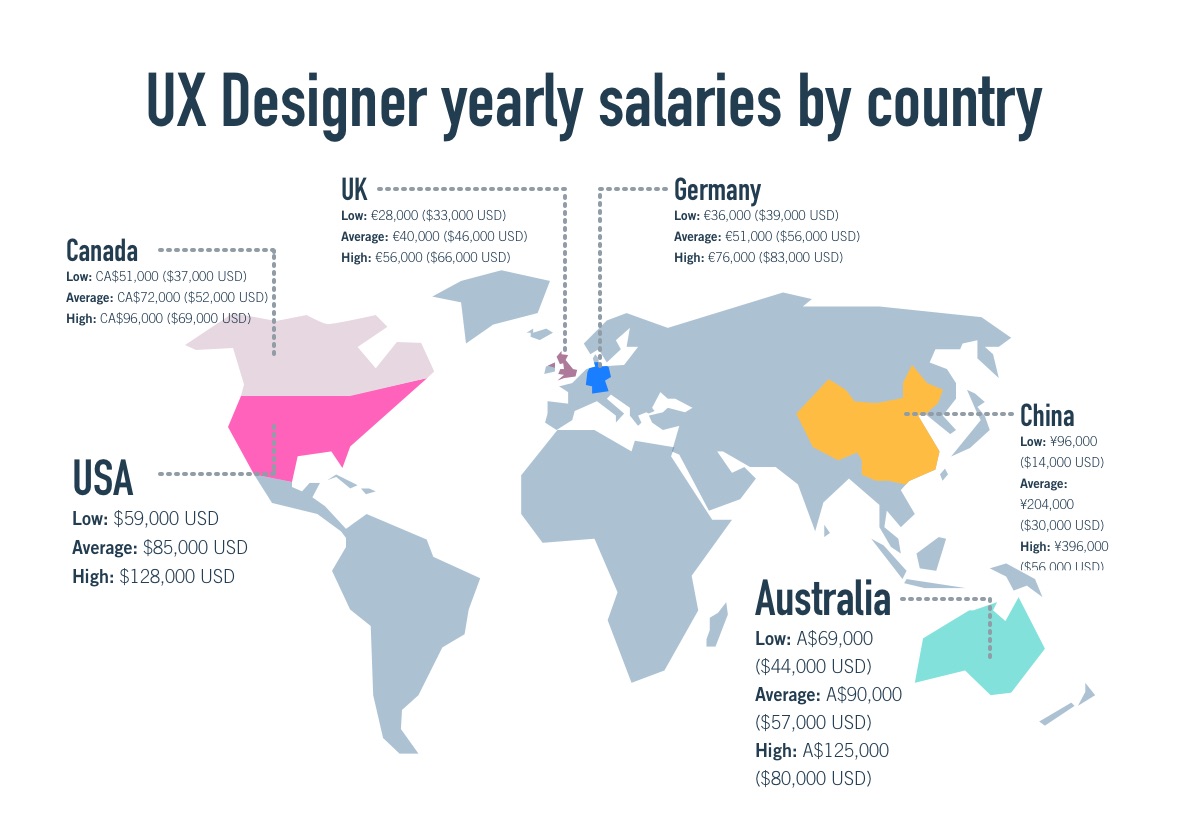

What Is The Average Ux Designer Salary 2021 Guide

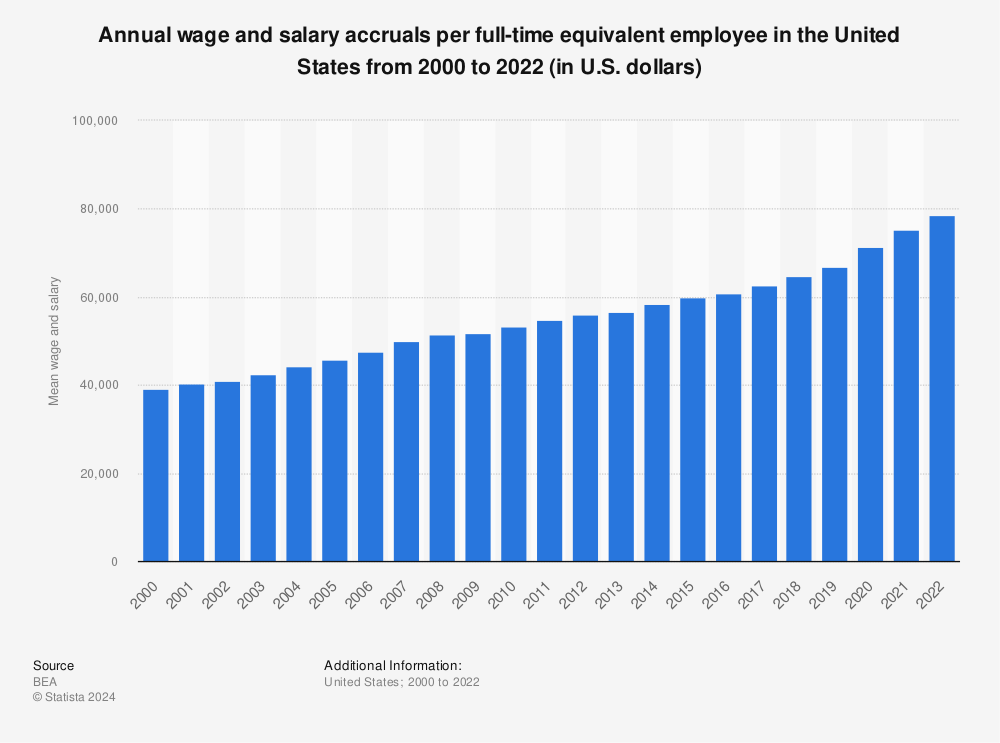

Average Hourly Wages In New Zealand Figure Nz

Employee Annual Leave Record Spreadsheet Editable Ms Excel Template Excel Templates Annual Leave Excel Templates Business Worksheet

What Is The Average Ux Designer Salary 2021 Guide

Base Salary Explained A Guide To Understand Your Pay Packet N26

Hourly Vs Salary Pros And Cons Quill Com Blog

Mckinsey Salary 2020 By Positions Locations Mconsultingprep

Changing An Employee S Salary Or Hourly Rate Myob Essentials Accounting Myob Help Centre

Base Salary Explained A Guide To Understand Your Pay Packet N26

4 Ways To Calculate Annual Salary Wikihow

Post a Comment for "How To Work Out Annual Salary From Hourly Rate Nz"