How Do I Calculate My Annual Income After Taxes

Youll then get a breakdown of your total tax liability and take-home pay. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more.

How To Calculate Income Tax In Excel

Now we can calculate their after-tax income.

How do i calculate my annual income after taxes. Therefore the individuals total annual taxes are 2115750. To calculate the individuals after-tax income we must first calculate their total taxes by summing up their tax rates. The deductions available to the taxpayer is deducted from gross total income this is the net total income.

Find out the benefit of that overtime. If you earn 40000 in a year you will take home 30840 leaving you with a net income. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income.

This is a break-down of how your after tax take-home pay is calculated on your 40000 yearly income. Income Tax Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax. For this example the employee would pay 5000 USD in federal taxes and 3000 USD in state taxes.

To better compare withholding across counties we assumed a 50000 annual income. Once that is done you shall be able to calculate your income tax as per the latest tax regimes and calculations. 75000 x 02821 2115750.

Also known as Gross Income. First we calculated the semi-monthly paycheck for a single individual with two personal allowances. This calculator assumes youre employed as self-employed national insurance rates are different.

This is only a ready reckoner that makes standard assumptions to estimate your tax breakdown. Youll then get a breakdown of your total tax liability and take-home pay. We applied relevant deductions and exemptions before calculating income tax withholding.

Your Adjusted Taxable Income is 60000 Low Income Tax Offset LITO of up to 100 and a Low And Middle Income Tax Offset LMITO of up to 1080 This calculator is an estimate. To calculate your gross annual income using this scenario take the sum of all of these income sources as follows. Also known as Gross Income.

Gross annual income refers to all earnings Earnings Before Tax EBT Earnings before tax or pre-tax income is the last subtotal found in the income statement. There are many other possible variables for a definitive source check your tax code and speak to the tax office. Then the Calculator will ask you to add the details of any other deductions that you may have.

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. 50000 60000 5000 115000 This means you earned a total gross income of 115000 during that year. Salary Before Tax your total earnings before any taxes have been deducted.

Business income before taxes. The gross total income is the sum of income under the six income heads. Applying the standard rate of 20 to the income in your weekly rate band applying the higher rate of 40 to any income above your weekly rate band adding the two amounts above together.

The tax is payable at the applicable tax rate or tax slab on the net income. How to use the Take-Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. We then indexed the paycheck amount for each county to reflect the counties with the lowest withholding burden or.

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k. Income tax is payable on the total income and not the gross total income as calculated in accordance with the income tax act. Can be used by salary earners self-employed or independent contractors.

Total Taxes 1413 543 865 2821. After-Tax Income Gross Income Taxes. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

After that you need to add the details of your 80D deductions. How Income Taxes Are Calculated. Salary Before Tax your total earnings before any taxes have been deducted.

Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income. If you are paid weekly your Income Tax IT is calculated by. Use our free online income tax calculator to work out your monthly take-home pay and view the income tax tables for individuals for the 2022 tax year.

Superannuation is part of your wage salary package and paid into your Superannuation fund. To compute the salary after tax one would simply multiply the gross income 100000 by each of the tax rates. Annual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual.

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Your Bullsh T Free Guide To Taxes In Germany

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Your Bullsh T Free Guide To Taxes In Germany

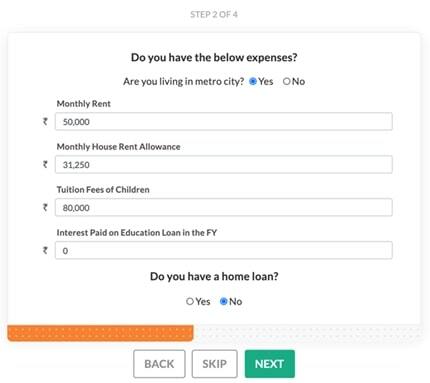

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

25 000 After Tax 2021 Income Tax Uk

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Use The Annual Income Calculator

Your Bullsh T Free Guide To Taxes In Germany

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "How Do I Calculate My Annual Income After Taxes"