Calculate My Yearly Income Uk

If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. The calculator is updated for the UK 2021 tax year which covers the 1 st April 2021 to the 31 st March 2022.

How To Calculate Salary Increase Percentage In Excel Free Template Salary Increase Salary Excel

The operation is simple enough.

Calculate my yearly income uk. Or Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. The 20202021 UK Real Living Wage is currently 1075 in London and 930 elsewhere. If your salary is 45000 a year youll take home 2853 every month.

Please see the table below for a more detailed break-down. Just enter your salary. As this tax calculator is based upon annual calculations it is working out deductions on an end of year basis and these will correlate with your pay records as long as the pay from period to period is regular or if the amount entered into the calculator.

Please now enter your net household income and the period over which you have calculated it. Pay will be calculated using the rules for Pay as You Earn meaning taxes are worked out cumulatively so are reliant upon the amount of income taxation and allowance up to each pay period within the tax year. If you have benefits in kind you can enter two different BIK value sot compare the differences too.

An easy to use yet advanced salary calculator at your fingertips. Wage is normally used to describe your monthly gross income. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

Between 50271 and 150000 youll pay at 40 known as the higher rate and above 150000 youll pay 45 the additional rate. All bi-weekly semi-monthly monthly and quarterly figures. Find out your take-home pay - MSE.

D is the number of days worked per week. You can also optionally enter a second gross salary to compare against the first. Use the service to.

Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. Check your tax code and Personal Allowance. Enter the year to date income in the YTD box choose the start date then the ending date and click outside the box or click calculate button.

Your net wage is found by deducting all the necessary taxes from the gross salary. When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator. The following calculator can be used to calculate your hourly to salary rate.

Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. See if your tax. How to use the Take-Home Calculator.

Note that your personal allowance decreases by. The median monthly household income in the United Kingdom is 2491 before deductions such as income tax and National Insurance payments have been made. Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5.

To use the tax calculator enter your annual salary or the one you would like in the salary box above. Annual Income Formula. Set the net hourly rate in the net salary section.

This is very useful is you are wondering what the difference a pay rise will make - or comparing salaries from two jobs. Find out the benefit of that overtime. Enter the number of hours and the rate at which you will get.

Where P is your hourly pay rate. The adjusted annual salary can be calculated as. This web calculator is ideal for mortgage pre-qualification.

The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more. How to use our Tax Calculator To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. H is the number of hours worked per day.

Where BO is bonuses or overtime. This equates to an annual salary of 29900 annually although it should be noted that this figure represents the income of a household not an individual. Annual Salary PDHWBO.

This service covers the current tax year 6 April 2021 to 5 April 2022. W is the number of weeks worked per year. There are two ways to determine your yearly net income.

First you will need to add together the incomes of yourself your partner and anyone else who lives with you after deducting income tax and national insurance. Your gross hourly rate will be 2163 if youre working 40 hours per week. Check your Income Tax for the current year.

This is based on Income Tax National Insurance and Student Loan information from April 2021. Use this calculator to estimate the monthly and annual year to date income. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more.

On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. In addition to wage or salary income dont forget to include any benefits you receive income from savings and investment profits or losses from self-employment and any other sources of income.

German Income Tax Calculator Expat Tax

50 000 After Tax 2021 Income Tax Uk

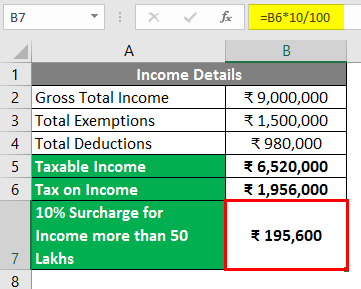

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Net Income 12 Steps With Pictures Wikihow

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube

Uk Tax Calculator 2015 2014 2013 Salary Calculator 2013 Listentotaxman Paye Income Tax Calculator Payslip How Calculator Ideas Salary Calculator Repayment

Income Tax Calculator Calculate Your Income Tax Online In India

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Income Tax In Excel

Career Lesson Wage Conversion Chart Hourly Pay Is Converted To Monthly And Yearly Pay To Help Kids Calculate Their I Career Lessons Conversion Chart Lesson

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Calculator For Fy 2021 22 Calculate Income Tax Online For Old Tax Regime

Important Things In Your Payslips Need To Check In 2021 Payroll Template National Insurance Number Payroll Software

Online Calculator Accounts House Chartered Certified Accountants Savings Calculator Online Calculator Certified Accountant

How To Calculate Net Income 12 Steps With Pictures Wikihow

Download Uk Vat Purchase Register Excel Template Exceldatapro Excel Templates Templates Excel

Post a Comment for "Calculate My Yearly Income Uk"