Calculate Annual Income Singapore

Calculate pay for an incomplete month of work for monthly-rated employees. 52 average number of days an employee is required to work in a week.

What Is Inflation Infographic Infographic Health Personal Finance

As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

Calculate annual income singapore. The adjusted annual salary can be calculated as. The Median Singaporean Household Income Is 7744. For a monthly-rated employee the basic rate of pay for 1 day is calculated as follows.

12 monthly basic rate of pay. Do not exclude the CPF employee portion when you key in this figure. Salary Before Tax your total earnings before any taxes have been deducted.

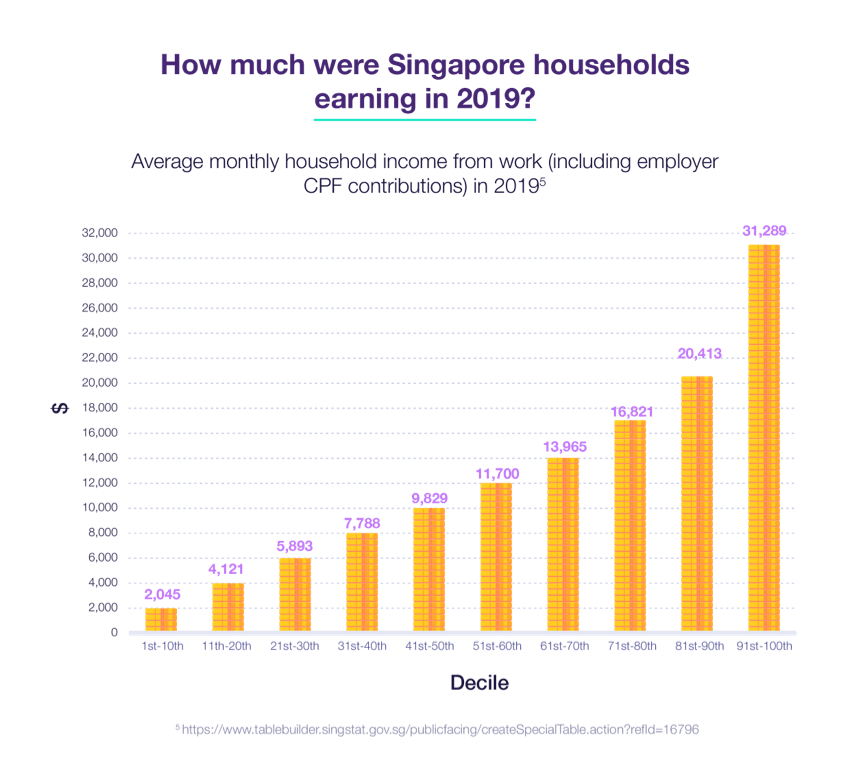

The most common one is that any CPF contributions are tax deductible 37 of your income 17 from employer and 20 from employee you also get an NSman NSman wife or NSman parent relief between 750 and 5000. 8000 - Employee CPF Contribution Relief. The median household income from work per household member is at 2463.

Calculate public holiday pay. Personal Reliefs - Earned Income Relief. Household income is the sum of the gross income of all the members of a household.

Key in your Gross Employment Income over the past year along with any bonuses fixed allowances and any benefits in kind that you have generated. Guidelines for Annual Wage Supplement AWS bonuses and other variable payments. Total Employment Income in 2020.

This is the average monthly salary including housing transport and other benefits. By contrast an employee who is paid 25 per hour is paid 2000 every two weeks only if they actually work 8 hours per day 5 days per week 25 x 8 x 5 x 2. Household monthly income per person is the total gross household monthly income divided by total number of family members sharing the same address as reflected on the NRIC or Birth Certificate.

This number is derived by adding up the total of all incomes being earned in Singapore and dividing it by the number of households nationwide. The formula is such as follow. Once completed please mail the form and supporting documents if any to PO.

The calculator will produce a full income tax calculation simply by entering your Annual income alternatively. Here we put together a tool for you to automatically prorate. For income of a typical worker look at the median gross monthly income.

If you are interested in wage increases that employers give over the year then look at the annual wage changes. Salaries range from 2140 SGD lowest average to 37700 SGD highest average actual maximum salary is higher. Monthly gross rate of pay Total number of days the employee work.

In our clients case that would be the reduced salary amount. The Singapore Annual Income Tax Calculator is designed to provide you with a salary illustration with calculations to show how much income tax you will pay in 202122 and your net pay the amount of money you take home after deductions. Calculate pay for incomplete month.

This is the income in the middle after the workers are ranked by their income. Assuming you had to pay taxes on a salary of 3949 you first need to know your deductibles to find out your chargeable income. Salaries vary drastically between different careers.

Singapore Prorated Salary Salary for Incomplete Month of Work Calculator This calculator which calculates salary for incomplete month of work is catered to employers and employees of all industries including service industries eg. How it is calculated. Youll then get a breakdown of your total tax liability and take-home pay.

FB retail professional services. Box 680 Bukit Merah Central Post Office Singapore 911536. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Singapore affect your income.

Our client wanted to know in case of termination if the leave would be calculated based on the reduced salary amount or the original full salary. ICalculator Singapore Income Tax Salary Calculator is. You can work out your annual salary and take home pay using the Singapore salary calculator or look at typical earning by entering a figure in the quick calculator or viewing one of the salary examples further down this page.

A person working in Singapore typically earns around 8450 SGD per month. Another useful figure is the average monthly household income. Chargeable Income Assessable Income less Personal Reliefs 234100 249750 - 15650.

For incomplete month salary calculator singapore it should base on daily rate of pay multiply by Total number of days the employee actually worked in that month. The individuals gross income every two weeks would be 1923 or 50000 divided by 26 pay periods. Calculate your pay for working on a public holiday or for a public holiday falling on a non-working day.

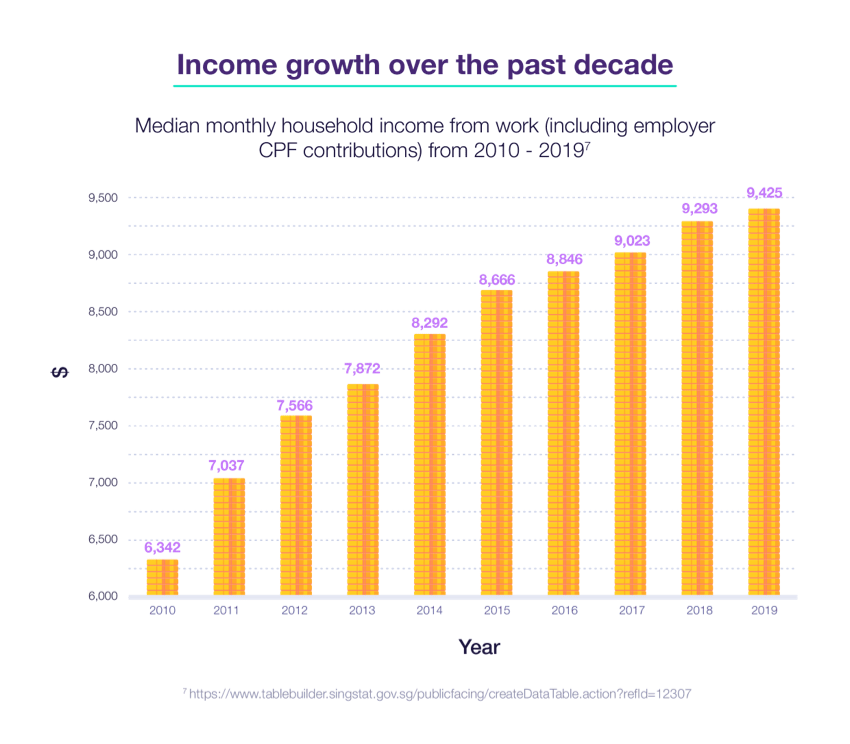

Singapore Personal Income Tax Calculator. At Talenox we believe in designing HR experiences for people not personnel. In 2019 the median monthly household income from work per household member including employer CPF contributions1 was 2925.

30 8 260 - 25 56400. The formal rule affecting this situation is that the encashment of unused leave should be calculated at the gross rate of pay based on your last drawn salary. Also known as Gross Income.

For households with at least one working person the median household income for Singaporeans is 7744.

Download Salary Sheet Excel Template Exceldatapro Excel Templates Payroll Template Worksheet Template

The Average Salary In Singapore 2021 Can You Afford A Condo With Your Income New Academy Of Finance

Which Countries Use The Most Electricity Https Www Statista Com Chart 19909 Electricity Consumption Worldwi Electricity Consumption Electricity Infographic

Singapore Annual Salary Calculator 2021 22 Income Tax Calc

The Sixth Edition Of The World Ultra Wealth Report Analyzes The State Of The World S Ultra Wealthy Population According To Wealth Inequality Growth Hong Kong

Infographic The Cities Home To The Ultra Rich Net Worth Infographic Crazy Rich Asians

Sample Promissory Note Form Template Radiodignidad Org Payroll Template Payroll Software National Insurance Number

Imf Global Housing Watch Real Estate Infographic House Prices Global Home

Are You Earning Enough Singapore S Average Household Income Revealed Standard Chartered Singapore

Do You Know That If You Qualify Under The Nor Scheme You Will Only Be Taxed For The Portion Of Your Singapore Business Business Infographic Business Solutions

Salary Calculation Sheet Template As The Name Indicates Is A Spreadsheet That Helps Calculate Each Employ Payroll Template Spreadsheet Design Excel Shortcuts

Working Adults What Is A Good Salary In Singapore

Average Salary In Singapore 2020 Average Monthly Earnings Ame Explained Turtle Investor

Household Wealth Inequality And Assets By Race In The Usa In 2021 Inequality Disasters Natural Disasters

Percent Discount And Sales Tax Assignment Project 7th Grade Math Math Curriculum Math Classroom

Singapore Salary Guide How The Median Income Has Increased Over The Years And Why This Figure Really Should Not Matter

Are You Earning Enough Singapore S Average Household Income Revealed Standard Chartered Singapore

Annual Income Tax Filling Free Ads Classified Income Tax Income Tax Return Tax Return

Koppen Climate Types Of The Us West Coast Us West Coast West Coast Climates

Post a Comment for "Calculate Annual Income Singapore"